How many pairs should a beginner trade. Novedad aquí - What pairs should a beginner trade with

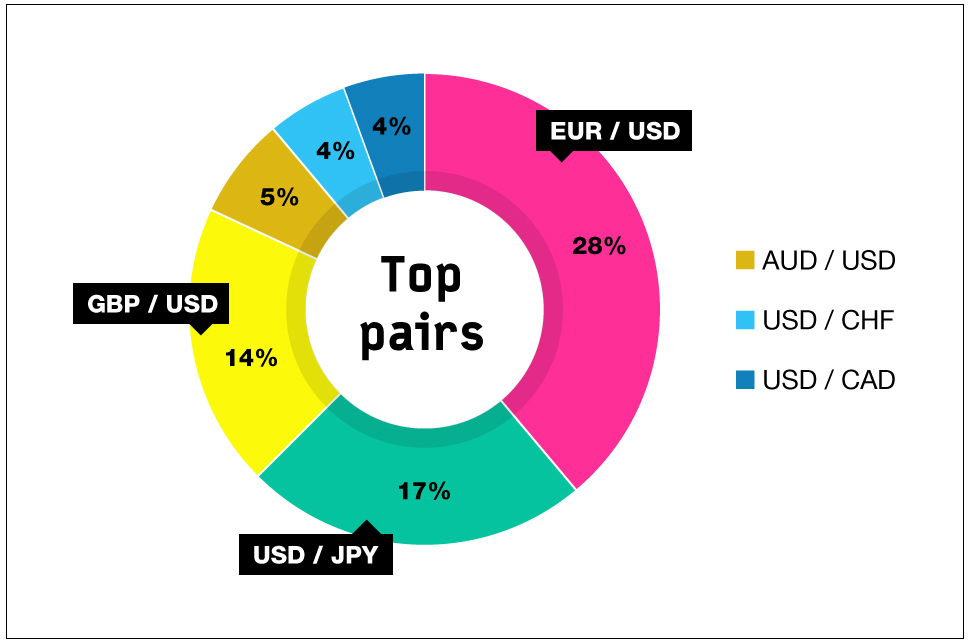

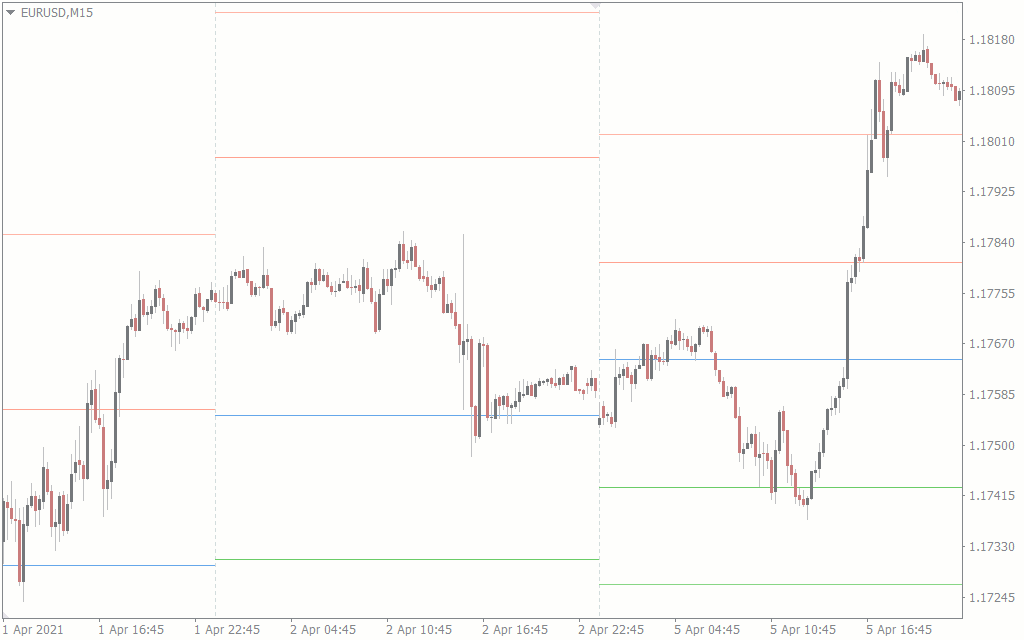

What is the Easiest Currency Pair to Trade EUR/USD is not just the easiest, but also the most stable currency pair to trade. It is the best choice not only among beginners but also for professional traders. This is one of the most traded currency pairs due to tight spreads and liquidity.

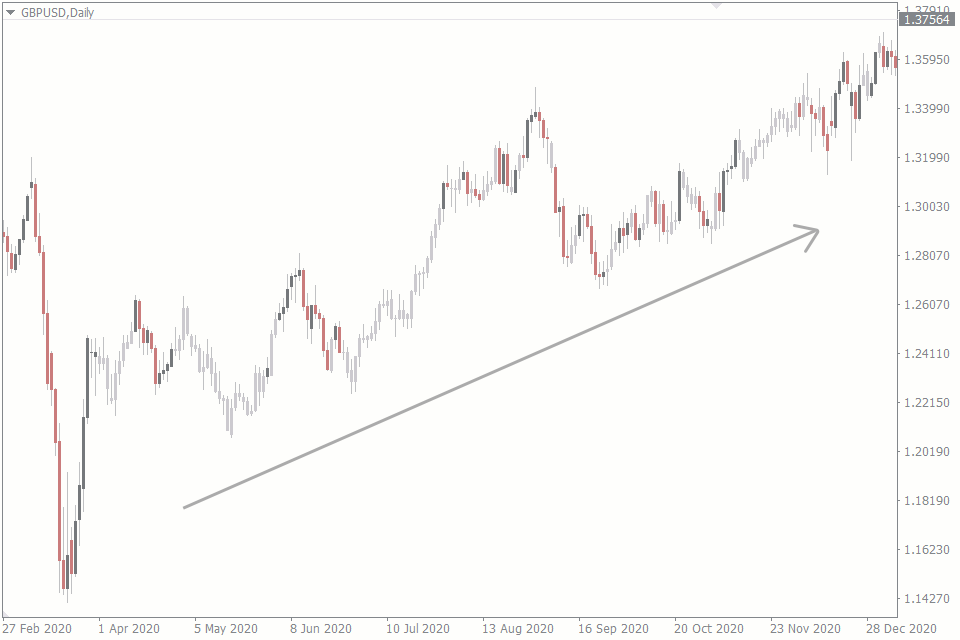

What is the Easiest Currency Pair to Trade EUR/USD is not just the easiest, but also the most stable currency pair to trade. It is the best choice not only among beginners but also for professional traders. This is one of the most traded currency pairs due to tight spreads and liquidity.A good rule of thumb for traders new to the market is to focus on one or two currency pairs. Generally, traders will choose to trade the EUR/USD or USD/JPY because there is so much information and resources available about the underlying economies. Not surprisingly, these two pairs make up much of global daily volume.

If you're just starting out, try to focus on 5 to 10 currency pairs. This will give you a few quality opportunities each month without it becoming overwhelming. By maintaining a list this size, you'll have more time to study and learn the process of becoming successful.

The numbers five, three and one stand for: Five currency pairs to learn and trade. Three strategies to become an expert on and use with your trades. One time to trade, the same time every day.

What is the cheapest pair to trade

EUR/USD Pair: Spread Begins from 0.1pips EUR/USD is one of the most traded pairs in the forex market, and it is also best for beginners as it has a very low spread. This means that traders can start with a small capital and still make reasonable profits with this pair.What is the safest forex pair to trade

“The Swissie” is a combination of the US dollar and the Swiss franc. For many years, the financial stability of Switzerland has been used as a 'safe haven' for investors of the forex market, who will rely on trading the CHF in times of market volatility.Key Takeaways. The five percent rule, aka the 5% markup policy, is FINRA guidance that suggests brokers should not charge commissions on transactions that exceed 5%.

The Securities and Exchange Commission (SEC) requires trades to be settled within a three-business day time period, also known as T+3. When you buy stocks, the brokerage firm must receive your payment no later than three business days after the trade is executed.Which forex pairs to avoid

The most volatile major currency pairs are: AUD/JPY (Australian Dollar/Japanese Yen) NZD/JPY (New Zealand Dollar/Japanese Yen) AUD/USD (Australian Dollar/US Dollar)

And one of the most common requirements for trading the stock market as a day trader is the $25,000 rule. You need a minimum of $25,000 equity to day trade a margin account because the Financial Industry Regulatory Authority (FINRA) mandates it. The regulatory body calls it the 'Pattern Day Trading Rule'.

In investing, the 80-20 rule generally holds that 20% of the holdings in a portfolio are responsible for 80% of the portfolio's growth. On the flip side, 20% of a portfolio's holdings could be responsible for 80% of its losses.The fifty percent principle is a rule of thumb that anticipates the size of a technical correction. The fifty percent principle states that when a stock or other asset begins to fall after a period of rapid gains, it will lose at least 50% of its most recent gains before the price begins advancing again.

The Euro/US dollar pair is regarded as the most profitable currency pair in forex for the following reasons; High Liquidity: The European economy is the second-largest globally, while the US is the largest.In statistical arbitrage, pairs trading is usually considered a risk-neutral strategy.

What should be avoided in forex

5 Common Forex Trading MistakesNot Doing Your Homework. Currency pairs are closely linked to national economies and are affected by many factors.Risking More than You Can Afford. One common mistake new traders make is misunderstanding how leverage works.Trading without a Net.Overreacting.Trading from Scratch.You need a minimum of $25,000 equity to day trade a margin account because the Financial Industry Regulatory Authority (FINRA) mandates it. The regulatory body calls it the 'Pattern Day Trading Rule'.“The Swissie” is a combination of the US dollar and the Swiss franc. For many years, the financial stability of Switzerland has been used as a 'safe haven' for investors of the forex market, who will rely on trading the CHF in times of market volatility.Day Traders in America make an average salary of $116,895 per year or $56 per hour. The top 10 percent makes over $198,000 per year, while the bottom 10 percent under $68,000 per year.It's recommended that day traders start with at least $30,000, even though the legal minimum is $25,000. That will allow for losing trades and more flexibility in the stocks that are traded.

Why do 95 percent traders fail

The Number #1 reason why traders fail is that they have no strategy. A lot of traders don't want to acknowledge this but the fact is they have no idea what they are doing. Their idea of a strategy is some combination of technical indicators that they have heard or read somewhere.One popular method is the 2% Rule, which means you never put more than 2% of your account equity at risk (Table 1). For example, if you are trading a $50,000 account, and you choose a risk management stop loss of 2%, you could risk up to $1,000 on any given trade.

Key Takeaways The 1% rule for day traders limits the risk on any given trade to no more than 1% of a trader's total account value. Traders can risk 1% of their account by trading either large positions with tight stop-losses or small positions with stop-losses placed far away from the entry price.

The way to make money fast in forex, is to understand the power of compound growth. For example, if you target 50% a year in your trading, you can grow an initial $20,000 account, to over a million dollars, in under 10 years. Break the norm, and gain more.What Are the Best Currency Pairs to Trade in ForexUS Dollar (USD)Euro (EUR)Australian Dollar (AUD)Swiss Franc (CHF)Canadian Dollar (CAD)Japanese Yen (JPY)British Pound (GBP) Below, we review ten risky investments and explain the pitfalls an investor can expect to face.Oil and Gas Exploratory Drilling.Limited Partnerships.Penny Stocks.Alternative Investments.High-Yield Bonds.Leveraged ETFs.Emerging and Frontier Markets.IPOs.

Below, we review ten risky investments and explain the pitfalls an investor can expect to face.Oil and Gas Exploratory Drilling.Limited Partnerships.Penny Stocks.Alternative Investments.High-Yield Bonds.Leveraged ETFs.Emerging and Frontier Markets.IPOs.

Similar articles

- ¿Cómo se les dice a las personas que juegan en los casinos. Novedad aquí - ¿Cómo se llama la persona que juega en casinos

- ¿Dónde ver España sub 21 vs Lituania. Novedad aquí - ¿Dónde ver España vs Lituania hoy

- ¿Cómo ver el partido Qatar vs Ecuador en vivo. Novedad aquí - ¿Dónde ver el Mundial Qatar 2022 Ecuador

- ¿Cómo hago para cobrar el bono. Novedad aquí - ¿Cómo saber si tengo derecho al bono social

- ¿Dónde ver Serbia Finlandia. Novedad aquí - ¿Dónde ver los partidos del Eurobasket 2022

- ¿Qué números se pueden poner en el Euromillón. Novedad aquí - ¿Qué números se ponen en el Euromillón

- ¿Qué es hacer un all in. Novedad aquí - ¿Qué pasa cuando se hace un all in

- ¿Cómo poner la pantalla completa en la TV. Novedad aquí - ¿Cómo hacer para que la pantalla de la TV se vea completa

- ¿Cuántos clasicos ganó Nacional. Novedad aquí - ¿Cuántos clasicos ha ganado Nacional

- ¿Cómo usar bono Casino bplay. Novedad aquí - ¿Cómo utilizar el bono de casino en BetPlay

- ¿Cuánto dinero gano Rybakina. Novedad aquí - ¿Cuánto dinero gana el campeón de Wimbledon 2022

- ¿Cuándo son los Supercopa de Europa 2022. Novedad aquí - ¿Cuándo se juega la Supercopa de Europa 2022

- ¿Cuántas rpm alcanza un f1 2022. Novedad aquí - ¿Cuántos rpm llega un F1

- ¿Cuánto gana un jugador de Universitario de Deportes. Novedad aquí - ¿Cuánto vale la plantilla de Universitario 2022

- ¿Dónde ver el partido de Inter de Milan. Novedad aquí - ¿Dónde televisan el Inter de Milán Real Madrid

Popular articles

- ¿Cuál es el mejor día para pagar la tarjeta de crédito. Novedad aquí - ¿Cuándo es el mejor momento para pagar la tarjeta de crédito

- ¿Qué frutas son ricas en hierro. Novedad aquí - ¿Cuál es la fruta con más hierro

- ¿Cuántas horas son a Ciudad Juárez en camion. Novedad aquí - ¿Cuántas horas son en autobús a Ciudad Juárez

- ¿Quién va a ganar Balón de Oro 2021. Novedad aquí - ¿Quién gana el Balón de Oro 2021 hoy

- ¿Cuánto dinero gana un tipster. Novedad aquí - ¿Cuánto ganan los apostadores profesionales

- ¿Cómo apostar la ruleta. Novedad aquí - ¿Cuál es la mejor forma de apostar en la ruleta

- ¿Cómo crear un VPN en mi celular. Novedad aquí - ¿Cómo crear un VPN en mi celular gratis

- ¿Cuántos equipos suben a Primera División 2023 Perú. Novedad aquí - ¿Cuántos suben a Primera 2023

- ¿Cuánto cobra un crupier de Las Vegas. Novedad aquí - ¿Cuánto gana un crupier en Las Vegas

- ¿Cuánto te paga el banco por un millón de pesos. Novedad aquí - ¿Cuánto me dan de intereses por un millón de pesos

- ¿Qué parte del mundo es de día todo el año. Novedad aquí - ¿Qué país son 6 meses de día y 6 meses de noche

- ¿Cómo sacar dinero exchange. Novedad aquí - ¿Cómo sacar mi dinero de exchange

- ¿Cuánto consume ver la tele por internet. Novedad aquí - ¿Cuántos megas consume la TV por Internet

- ¿Cómo quedó la final de balonmano. Novedad aquí - ¿Dónde ver Final Europeo balonmano 2022

- ¿Cómo ganar en las apuestas de juegos virtuales. Novedad aquí - ¿Cómo ganar en los juegos virtuales